Connections Matter: Trump, Vance in the investment context

Market Outlook and connections you should be aware of as an investor. Microsoft, Palantir and Crypto.

This post comes from a slightly different angle as usual but will nonetheless be insightful for many nevertheless. But first, we would like to reiterate the current market view:

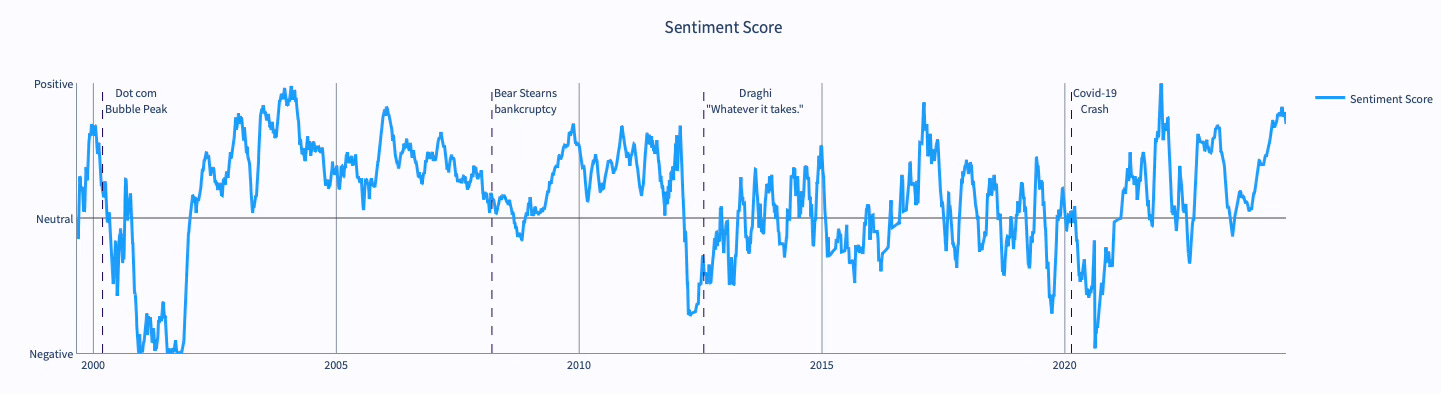

We remain of the opinion that the market is already pretty stretched. As of writing, the SPY ETF already gained >15% YTD. Measures like Sentiment and Market Microstructure remain at pretty high levels in comparison to the last couple of years. Further upside might be as well possible, but caution still needs to be practiced at these levels, based on historical context.

Sentiment Index

Source: macro.dcorr.de

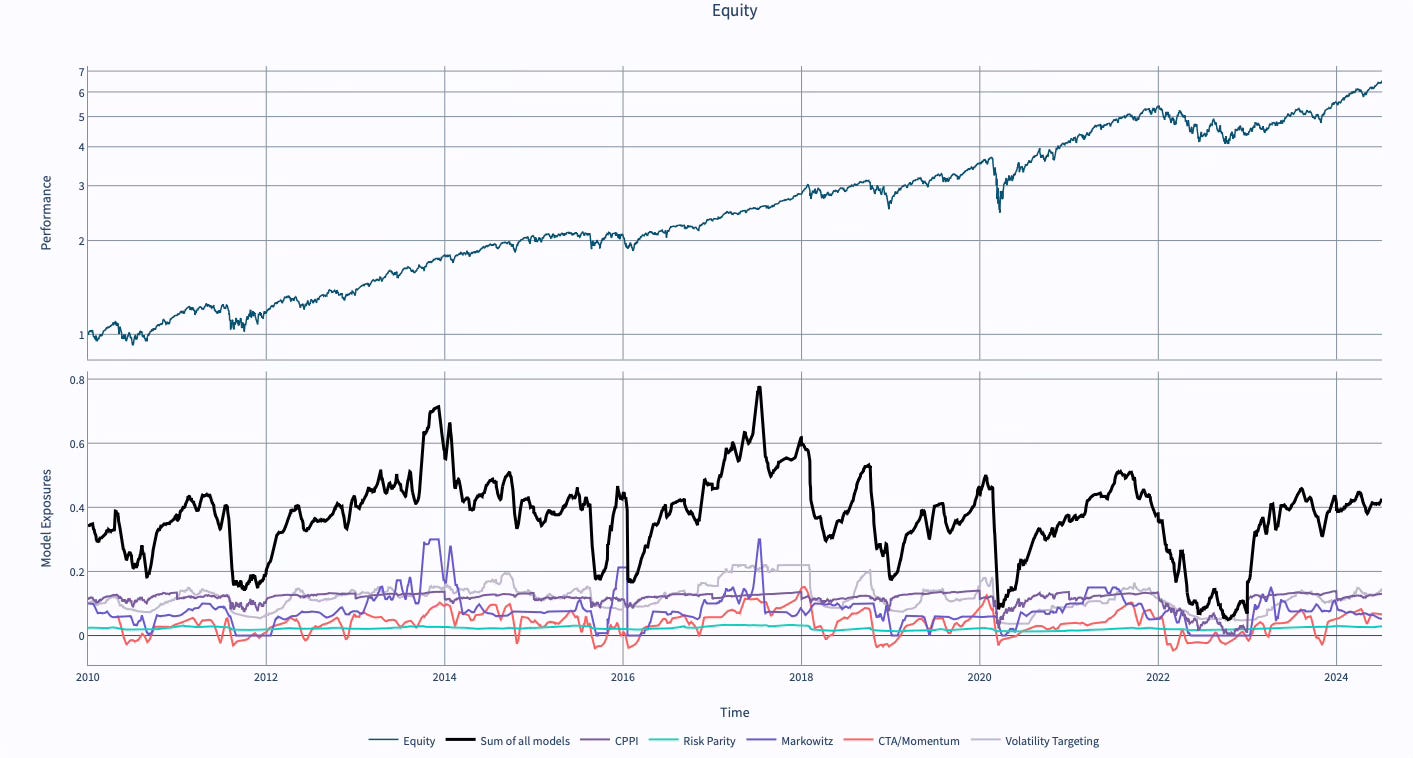

Market Microstructure

Source: macro.dcorr.de

A rapidly rising MOVE or VIX Index could end the party rather fast as a rise in Bond volatility would reduce risk budgets for most algorithmic models (CPPI, Risk Parity, Volatility Targeting and even CTA’s). A rapid rise in VIX would also directly impact the allocations but furthermore impact the notional traded via options.

A great time for alpha, if beta starts to get less easy to collect.

On the point of alpha and coming back to our initial topic. The recent drop-out of Joe Biden from the presidential race and Trump’s VP nomination, JD Vance.

Betting markets continue to price Trump as the clear winner against every other candidate (https://polymarket.com/event/presidential-election-winner-2024). Currently priced at 65% in favor of Trump and 29% in favor of Kamala Harris. For everyone looking at approval ratings, it seems rather unclear why Harris should be a better pick than Biden (https://projects.fivethirtyeight.com/polls/approval/kamala-harris/), but Harris’s VP nomination might be a surprise to the upside for her ratings. Michelle Obama is frequently circled as a potential candidate or VP.

But how to profit from the coming election and the potential victory of Donald Trump? Of course, we don’t have a crystal ball either and this is, as always, no investment advice. Let’s assume Trump and Vance are winning in November:

As of our research, JD Vance previously had very close ties with Peter Thiel, going back to the 2010’s (https://www.msn.com/en-us/money/companies/peter-thiel-plays-kingmaker-again-as-trump-picks-jd-vance-for-veep/ar-BB1q4PEE). Thiel already played a big role in Trump’s previous presidential period and might have an even bigger influence in his next. Palantir therefore seems to be an obvious beneficiary.

With a more tech-friendly administration, Sam Altman and OpenAI should also be on the beneficiary list. Sam Altman is also connected to Thiel (https://de.wikipedia.org/wiki/Sam_Altman). With OpenAI being not publicly investible, Microsoft might be the closest stock to trade the effect. Already integrating OpenAI tools via Azure.

Furthermore, Elon Musk and his companies might be once again a very profitable place to invest. With Tesla facing potential backlash via Trump’s outspoken problem with EV’s, he might pivot the narrative of Tesla further to a robotics/AI company, maybe fueling another hype. If he considered bringing any of his other involvements, like SpaceX public, the next 4 years might also be interesting.

The most obvious beneficiary, however, might be Bitcoin and the crypto markets overall. The massive regulatory backlash, crypto faced during Joe Biden’s term certainly seems to be coming to an end. With massive support from the VC world for Trump, all their favorite portfolio companies which have been burning cash over the last 3–4 years should be ripe for another run up to the stars. With Trump speaking at the Bitcoin Nashville Conference this week, we might get a clearer picture of what might be happening.

As always, do your own research, but these bits of information should give an idea of where the potential winners of the coming presidential cycle might lie.

Disclaimers: Data provided comes from open sources, own calculations and tiingo market data. Data presented and used can be derived data. This does not constitute an offer, solicitation or recommendation to sell or an offer to buy any securities, investment products or investment advisory services. This information generated by the charts, tables, and graphs presented herein is for general informational and general comparative purposes only. This document may contain forward-looking statements that are based on our current beliefs and assumptions and on information currently available that we believe to be reasonable, however, such statements necessarily involve risks, uncertainties and assumptions, and investors may not put undue reliance on any of these statements. References to indices or benchmarks herein are for informational and general comparative purposes only. Indexes are unmanaged, partly hypothetical and have no fees or expenses. An investment cannot be made directly in an index. The information in this presentation is not intended to provide, and should not be relied upon for, accounting, legal, or tax advice or investment recommendations. Each recipient should consult its own tax, legal, accounting, financial, or other advisors about the issues discussed herein.